Keep the green tick to turn a category on. Click on the tick to make it a cross to turn the category off before clicking ‘Accept selected’.

Search results for ''...

Wills, trusts & tax planning

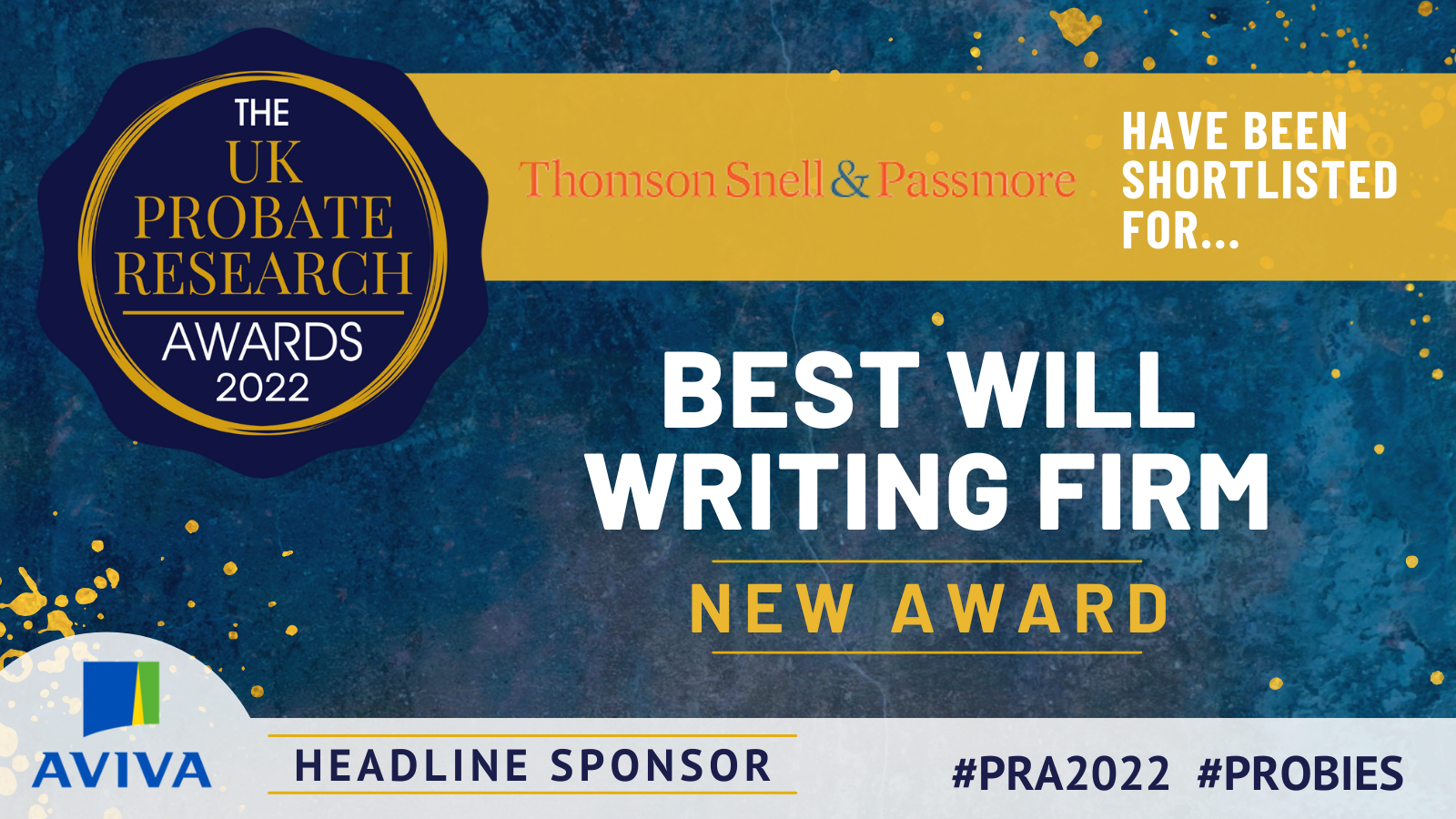

Recognised as one of the top 25 law firms by eprivateclient.

Related Services

For You

-

Overview

Expert will lawyers serving Kent and the South East

Our expert team of lawyers has been trusted by generations of families. We work with you to protect your (assets) and pass on your wealth to the next generation in the way which best suits your circumstances. We can also help minimise your tax liabilities.

To find out more about our specific wills, trusts and tax planning services, together with other related areas on which we can advise, please visit the individual pages below, or contact one of our team direct for advice.

- Wills & estate planning

- Trust creation & management

- Tax advice

- Lasting powers of attorney (LPAs)

- Probate

- Will disputes

- Trust disputes

- Deeds of variation and disclaimers

- Wills & estate planning for business owners.

Further helpYou can find more information on making wills in our information sheets ‘Making your will’ and ‘Wills – Frequently asked questions’ or for tax planning related legal matters FAQ - Tax Planning

If you require more specific estate planning advice, including costs, please read our 'Will and estate planning services' brochure, or contact us via the get in touch form or live chat facility to the right of this page.

More about the team

The team is best known for its structure of specialist lawyers who are top of their field in their specific area of law as detailed in the accreditations below. We work collaboratively through one client care partner to provide expert advice to clients.

- Most of our team who supervise and manage the preparation of wills are members of The Society of Trust and Estate Practitioners (STEP). It has published a Code for Will Preparation in England and Wales and as a firm, we adhere to this code in relation to work we do in connection with wills in this jurisdiction. We are independent and are not part of any other company or group. You can view the code on their website: www.step.org/ or we can send you a copy on request.

- Band 1 in Chambers HNW and The Legal 500

- Listed as one of the top law firms by ePrivateClient

- Kent Business Legal Sector Review 2021 – scored us as number 1 for private client quoting “ TSP leads the pack for Private Client once again”

- Lexcel - The practice is accredited by Lexcel for our excellence in legal practice management

- All of our partners are also listed as Citywealth leaders.

Get in touch

Contact us on 01892 510 000 or email us to discuss your requirements.

-

Related Client Stories

Providing an estate planning review for a farming family looking to undertake generational planning

Simon advised a couple who own a farm, including various areas of land, properties and two family trusts which held property.

Advising on various family trusts whilst administrating a couple’s estate

Following the death of a Husband and Wife, Simon was instructed by the family to advise on their estates, which left Will trusts, and other estate trusts. The estate had a value of around £3.5 - £4 million.

Leaving a limited interest to your surviving spouse could lead to a substantial IHT saving

Chris advised the family of a man who died leaving an estate of £7.5 million.

Specialist estate planning advice tailored to ever-changing family dynamics

Amy has acted for this couple since she was a trainee, with the matter transferring across with her from her previous firm.

Making your Will during COVID-19 – a client case study

The sale of multiple properties included in an Estate following complicated Probate

As a firm we were instructed to administer the estate of a widow who also held trust property from the estate of her Late husband. Each estate had different interests in the property and different beneficiaries.

Part gift and part sale of a substantial countryside property

The Conveyancing team worked closely with the Private Client and Employment departments, to provide a full and efficient service for the client.

Home Loan Schemes

Chris worked with the client to avoid further Inheritance Tax after their father and late mother participated in a “Home Loan Scheme.”

Having your cake and eating it: Interest and Tax free loans after Varying a Will

Chris advised the clients to put a portion of their £10 million inheritance from their late mother into Trust to potentially reduce the Inheritance Tax liability and ring-fence the assets.

Practical solution to a vague Form of Nomination

The client (a company) offered a Group Life Assurance Scheme (the Scheme) to its employees, but when one of their senior employees passed away leaving an unclear Form of Nomination they turned to Stuart from our Trusts department for a practical solution.

Disabled Person’s Interest trust

The client needed a trust for their child to allow them to live independently whilst ring-fencing the assets, but faced an Inheritance Tax liability if a mainstream lifetime trust structure was used.

Lessons learnt in the refinancing of a farming partnership

The Commercial Property and Private Client team work together on the refinancing of a farming partnership in which the majority of the land to be charged was unregistered and had devolved by deeds of gift and testamentary disposition to the current partners.

Heirs who have already inherited

A high net worth client who had already given substantial lifetime gifts to the children of their first marriage was unsure whether they wanted their children to receive more inheritance under their

High Net Worth Estate Planning

High net worth clients worth over £60 million were given peace of mind from the full service Thomson Snell & Passmore LLP offer.

Deed of Variation allowed client to be taxed at their children's lower rates

Our client's father-in-law died, leaving his estate to our client’s husband, who subsequently died. Our client was the beneficiary of both estates

Preparation of Deed of Variation to maximise Agricultural Relief

Mark advised the beneficiary of a Life Interest Trust created by her late husband’s Will. Mark prepared a Deed of Variation providing for her life interest in the farmland to pass to her children. The Deed was drafted to maximise and secure the Agricultural Relief currently available, in case the land ceases to qualify for the relief by the time of the beneficiary’s death.

Advice for two beneficiaries of an estate and their creation of Life Interest Trusts

Mark Politz advised two beneficiaries of an estate and created two Life Interest Trusts for their respective families.

Client advised not to transfer their home to their children

We advised a client when they came to us with instructions to transfer their home to their son and daughter. The client wanted to remain living in their home after the transfer.

Taking advantage of the double tax treaty

Chris advised a film director in a cross-border matter, which is valued at £6 million.

Efficient Estate Planning

Nicola advised two clients, following the sale of their business, in relation to efficiently planning their estates, in a matter valued at £25 million.

Assets near and far

Helen is leading in the administration of a cross-border and multimillion pound estate, which has multiple assets in England, Scotland and Portugal.

A trust combining tax saving with control

Stuart’s client inherited his wife’s share of some farmland, which had huge developmental potential.

Protecting the Family

Sarah advised a client with a complex family structure, in a matter valued at £1.5 million.

Cross-border estate planning

Clare provided estate planning advice and prepared new Wills for clients, in a matter valued at £12 million.

Marriage avoids potential double charge to Inheritance Tax!

The complete package

Ultra high net worth clients have complicated affairs. We are able to provide peace of mind through a complete advice service.

Peace of mind when entering a second marriage

A long-term client has recently entered into a second marriage and they wanted the interests of all the client’s children protected in a tax efficient way.

Managing a family's literary estate

One of our partners is a trustee of a trust which owns the copyright of a famous English comic author who died in the second half of the 20th century. Applying a flexible approach has enabled the author’s brand to develop, while in appropriate costs protecting the intellectual property rights.

Tax reduction on a substantial inheritance

During the administration of an estate, which included shares in a property investment company, our advice resulted in a capital gains tax saving of over £250,000 for the beneficiaries.

Estate planning review following re-marriage

We advised a wealthy client on changes to his Will that could save several million pounds in inheritance tax.

Capital gains tax saving for beneficiaries

Following a significant increase in the value of a property during the administration of an estate, we were able to achieve a substantial capital gains tax saving.

Tax planning disaster averted

Our clients were faced with a potential inheritance tax liability of over £1.2million but, following our intervention, HMRC accepted that no inheritance tax was due.

International musical estate

We advised the executors of a complex estate containing assets worth over £25million and we were able to reduce the inheritance tax bill by over £500,000.

Undercover security officer recovers damages for injuries following an assault at work

This case study demonstrates the expertise of our Personal Injury team who recently recovered a six figured sum for an undercover security officer who was assaulted by a suspected shop lifter.

Inheritance tax avoidance

This case study demonstrates the expertise of our Wills, Trusts & Tax Planning team who have recently advised a client on deeds of variation, inheritance tax and discretionary trusts.

Farming estates & inheritance tax

This case study demonstrates the expertise of our Wills, Trusts & Tax Planning team who have recently settled a farming case, saving a potential IHT liability of over £500,000.

-

Latest Updates

What changes does the Charities Act 2022 introduce?

Will my mum's forceful, spendthrift husband leave us with no inheritance? Can he borrow against the house after he runs through her small savings

How to approach the removal of executors

Thomson Snell & Passmore further demonstrates commitment to clients in later life

How does a will get revoked and what does it mean?

Testator beware: remote witnessing of wills extended

On the 11 January 2022, the Ministry of Justice announced that the temporary measures allowing for the remote witnessing of wills in England and Wales would be extended to January 2024.

Looking ahead to 2022: We can’t predict the future, but we can prepare for it

The end of the year is naturally a time to reflect on the past 12 months, and look ahead to the next.

007 – Licence to… Gift?

Daniel Craig has recently said he does not believe in leaving his estate to his children on his death, saying in an interview with Candis magazine, “I don’t want to leave great sums to the next generation.

Sustainable Farming Post-2028

Kate Cairnes recently wrote an article for South East Farmer Magazine

Thomson Snell & Passmore further strengthens Trust Management team with appointment of new Partner

Alan Kitcher joins as Partner – Certified Chartered Accountant from Charles Russell Speechlys

Court of Protection: Skewed benefit

Louise Mathias-Williams explores a case where a windfall jeopardised the beneficiary’s living arrangements

Mitigating your exposure to Capital Gains Tax: the window of opportunity

Grand Designs to gift land or property? Here is what you need to consider

Channel 4’s Grand Designs programme recently featured an inspirational couple who, despite both suffering from serious health issues, self-built their ‘dream home’ by renovating an old barn.

Thomson Snell & Passmore announces 11 promotions including three new Partners

Leading South East law firm Thomson Snell & Passmore announces 11 promotions from across its core practice areas.

Next generation family and estate planning

At Thomson Snell & Passmore, we have been here for you since 1570, and are here for all lifetime events on the Private Client side of our business that we can support you with.

Capital Gains Tax planning – a small window of opportunity?

There has been a lot of mumbling in the press over the last few weeks about the Government reviewing potential changes to Capital Gains Tax (CGT) in order to help fund the cost of the COVID-19 crisis.

The benefits of leaving money to charity in your will

The climate surrounding COVID-19 over recent months has changed the way our society works, and for many, the sight of Captain Tom Moore (and others like him) raising large amounts of money for charity may well be one of the defining images.

Love, Marriage and Estate Planning

Getting married or entering into a civil partnership is usually one of the most important days of any person’s life, and the preparations can take months in advance of the big day.

Complex considerations

UK trusts are still key to effective estate planning when it comes to complex families

Witnessing wills by WiFi – a last resort!

Key considerations for signing Wills via video link.

An Interview with Simon Mitchell

Witnessing a will in the time of coronavirus

With very limited exceptions, for a will to be valid, the person making the will must sign it in the physical presence of two witnesses who must then also sign the will.

Here for you – during COVID-19

Useful reminders for creating/updating your will or LPA

COVID-19: Changes to who, where and how deaths can be registered

Disputing a will: key considerations

Nicholas Horton considers the most common reasons people have concerns over wills.

Budget 2020 - changes to ER; gift while you still can

Budget 2020 saw amendments to Entrepreneurs' Relief (ER), which were widely expected. ER reduces the rate of capital gains tax (CGT) on disposals of certain business assets from 20% to 10%, subject to a lifetime limit. Before the Budget the lifetime limit

What is IR35?

IR35 is a piece of anti-tax avoidance legislation being rolled out to the private sector in April 2020, but what does that mean to your business?

Making a will, key considerations

One of our lawyers Amy Lane recently shared her thoughts on the importance of making a will with leading lifestyle publication SheerLuxe https://sheerluxe.com/2020/01/20/when-how-and-why-you-should-draw-will.

Why probate is only the first step in managing someone’s estate

When someone dies it can be a difficult time for family or friends who are left to deal with the deceased’s estate. At Thomson Snell & Passmore we aim to help the bereaved due to our joined up and client centric approach.

New Year – Estate Planning Tips

With the New Year comes new beginnings, and people start to turn their attention to setting resolutions and good intentions for the year ahead. Those should not only be limited to the traditional resolutions, so here are some inspirational financial resolutions for you to give some thought to:-

Tax efficient giving this Christmas

For many, Christmas involves giving money or gifts to family, friends and others and without wanting to sound too much like Scrooge.

Probate Delays – are we nearing the end?

Thomson Snell & Passmore welcomes HM Courts and Tribunal Service’s update that the backlog of grant applications is beginning to fall and they expect to resume normal service ‘very shortly’.

Changes to Inheritance Tax may be on the horizon

Chancellor Sajid Javid confirmed that curbing death duties was on his mind, after Housing Secretary Robert Jenrick backed a cut to Inheritance Tax (IHT) dubbing it as unfair that people were paying tax twice.

Passing your loyalty points over in your will

Life has become more digital over recent years, yet many people do not consider how to leave their digital assets on death, particularly loyalty points.

I'm writing a will - how do I choose an executor?

Experts advise the person to trust with this task should ideally be younger than you are.

The Office of Tax Simplification (OTS) has proposed to change Inheritance Tax (IHT) rules on gifting.

The Office of Tax Simplification (OTS) has proposed to change Inheritance Tax (IHT) rules on gifting.

Domicile – does a picture say a thousand words?

Johnny Hallyday died in 2017, which has caused an ongoing dispute between his widow and two children from a previous relationship. Johnny had spent much of his time in Los Angeles, having once said that he would never return to France unless their tax laws changed, following the introduction of 75% tax on income over €1million in 2014.

Avoid your beneficiaries getting the blues

It has been reported that Aretha Franklin left three handwritten wills at her Detroit home before her death, the latest one dated 2014 which has some information crossed through and some words hard to decipher.

Estates in administration – beware of the tax issues

When considering the tax issues surrounding a deceased person’s estate, most people will think of Inheritance Tax. But executors and other personal representatives should be aware that both Income Tax and Capital Gains Tax may apply during the period of administration.

The controversial “stealth tax” saga continues

Dubbed a “stealth tax” by critics, probate costs will increase under controversial plans to introduce a new sliding scale of probate fees. Subject to an approval motion in the House of Commons, the new fees will come into force 21 days after the order is made.

Changes to Capital Gains Tax

Capital Gains Tax can impact on a whole range of transactions and situations. We have highlighted some of the most recent changes, together with those that are currently being proposed, to this very complex area of the law.

Thomson Snell & Passmore is recognised as one of the UK’s Top Law Firms

Thomson Snell & Passmore has been named as one of the Top Law Firms for its private wealth practice for the fifth consecutive year.

Thomson Snell & Passmore boosts its Tax Planning Team with lateral hire

Leading South East law firm Thomson Snell & Passmore is pleased to announce that Simon Mitchell has joined the firm as a Partner. Simon has been appointed from Adams & Remers and has over 20 years’ experience specialising in wills, tax and estate planning.

Protecting your digital assets

There is an increasing amount of debate around what you should do to protect your online assets. Failure to recognise digital assets in estate planning can lead to loss of value for intended beneficiaries and may create unnecessary difficulties for your family or executors.

Post Panama Paper: are English trusts still trusted?

Trusts still remain under public scrutiny, but can their reputation be safeguarded

Owning a home with your partner

Grandma has left you some money, or the bank of mum and dad has lent you some. You decided to use the money to get on the housing ladder with your partner. How exciting!

I'm in my 20s. Why do I need a will?

Any lawyer will tell you that it is always sensible to have a will.

Will my granddaughter pay tax on my wedding gift to her?

I'm planning to give her £25,000

Protecting Wealth of Millionaire Millennials

Those who are aged under 30 and already fall into the high net worth bracket may have specific needs when it comes to future planning

Planning for all eventualities: The use of 'common tragedy clauses' in wills

Richard Cousins, chief executive of Compass Group, died in a seaplane crash with his two sons, fiancée, and her daughter on New Year’s Eve 2018.

For your business - October 2018

As a firm, we take pride in being a constant in a changing world. We hope this collection of articles will be helpful and provide food for thought on a number of topics.

Leaving a charitable gift in your will

Clare Morison explores the benefits of leaving a charitable gift in your will

I want to leave 95% of my wealth to charity - not my children

What is the best way to structure major charitable donations?

Give early, give often, but only give what you can afford

As property prices increase, more and more people are finding that they will be leaving an Inheritance Tax bill for their loved ones on their deaths.

Does your trust need to be registered?

Helping a grandchild onto the property ladder

We act for a wealthy couple who wanted to help their granddaughter onto the property ladder. Our private client team worked with the granddaughter, providing her with advice on how to protect her new wealth.

The Residence Nil Rate Band

The Residence Nil Rate Band (RNRB) has now been in force for a year and applies to estates where the deceased died on or after 6 April 2017. Where the deceased owned or, in some cases, had an interest in, a residence the RNRB makes available an additional tax free amount if the residence is inherited by someone closely related to the deceased.

Succession planning ‘vital’ for family business

Family businesses are central to the UK economy, accounting for approximately a quarter of the UK’s GDP and employing over 12.2 million people. However, in a recent PwC survey, 43 per cent of these family business owners confirmed that they do not have any sort of succession plan in place.

Power of attorney fee refund

The Ministry of Justice has announced a refund scheme for Lasting Powers of Attorney (LPA) and Enduring Powers of Attorney (EPA) application fees paid between 1 April 2013 and 31 March 2017.

Law Commission’s consultation on the law of wills

Thomson Snell & Passmore has responded to the Law Commission’s consultation on the law of wills.

FAQ: Frequently asked questions from across the practice

We regularly answer frequently asked questions from across the practice and bring them together to help bring clarity to your legal needs. Each of the sections below lead off to a more comprehensive bank of information.

FAQ: Tax Planning

Q. We want to help our 20 year old daughter buy her first flat, but we’re worried about putting such a valuable asset directly in her name. Is there anything we can do to protect the property until she’s a bit older?

Firm hire: Thomson Snell & Passmore

Leading South East law firm Thomson Snell & Passmore is excited to welcome Christopher Walker who joins the firm today as an equity partner in its renowned private client team.

Thomson Snell & Passmore’s Private Client team further bolstered by lateral hire

Leading South East law firm Thomson Snell & Passmore is excited to welcome Christopher Walker who joins the firm today as an Equity Partner in its renowned Private Client team.

IHT considerations for unmarried couples

Our Private Client team speaks to Professional Adviser about IHT considerations for unmarried couples and the practical steps they can take.

Industry call for clarity on digital legacies

New powers over what happens to digital legacies upon death have been called for by solicitors and legal academics

Digital legacies need legal protection say lawyers

Solicitor, Sarah Nettleship from our Private Client department speaks to The Law Gazette about digital legacies.

Inheritance tax is changing

The residence nil rate band is being introduced in stages between April 2017 and April 2020, subject to a number of conditions, some of them complex.

The net widens

Solicitor, Sarah Nettleship from our private client team speaks to ePrivate Client about the upcoming changes to IHT and the government’s reforms of taxation of ‘non-doms’.

Giving away shares in the family company

Giving away shares in the family company

FAQ: Family

Rental income: should the husband or wife receive it?

The end of another tax is a timely reminder to all those couples who are married or in a civil partnership to consider which of you should continue to receive the income from rental property. This article outlines the options available.

Reforms to the taxation of non-domiciles: The extension of deemed-domicile status

This article will focus on the position of the resident “non-dom” and the extension of deemed-domicile status but we will first take a look at what these terms mean and the current position.

Top 25 UK Law Firm

We are pleased to receive, for another year, the accolade from eprivateclient of being listed as one of the Top 25 Law Firms in the UK.

Dying tidily

In Dying Matters week, Nicola Plant wrote for Spears Magazine and produced a test to see how tidy you are, or whether you might need further advice on your Will, trusts or tax planning.

Law firm says its growth is organic

Local newspaper, Kentish Gazette (Canterbury) shares and insight into our organic growth. First published July 2015.

Are you aware of your digital assets?

For most of us, and increasingly irrespective of age, the digital world has crept into our lives. Whether we manage our bank accounts or investments online, store our photographs in the cloud or manage our social lives through Facebook, our digital footprints are becoming deeper and deeper.

-

Insights

A Business Lasting Power of Attorney

A Trust Corporation

Agricultural Relief

Business Relief

Declarations of Trust

Deeds of Variation

Disappointed by a Will?

Discretionary Trusts in Wills

Domicile

EPA - Registration of an Enduring Power of Attorney

EPA - The Role of an Attorney under Enduring Power of Attorney

Family Investment Companies

Helping children onto the property ladder

Jointly-owned property: joint tenants or tenants in common

LPA - a summary

LPA - information pack

LPA - the role of an attorney for property and finance

Lasting Power of Attorney (LPA) - fees

Life Interest Trusts

Making your Will

Outline of Inheritance Tax

Personal injury trusts

Principal Private Residence Relief Update

Probate for non-taxable estates

Probate for taxable estates

Rights of occupation in a property for non-married couples

Tax Return checklist

Tax year end planning for individuals

The Residence Nil Rate Band Download

Trust Management

Trust types - a key features guide

Trusts for Death Benefits

Wealth preservation

Will and estate planning services

Kirsty was always treated with courtesy and my questions were answered in full whether they were in person or by telephone by everyone I spoke to.

Client

Everything was handled professionally and courteously

Client

The service Nicola provided was highly professional; her flexibility with timescales was especially appreciated

Client

Rosie is an absolute star and it’s always been very reassuring to know that our affairs have been in such capable hands.

Client

Una is very professional and knows her stuff! Very competent, but also friendly.

Client

I was treated very professionally and all my queries were answered satisfactorily.

Nicola's experience and practical application of private client law coupled with her ability to really understand clients' requirements sets Nicola apart.

Client

The advice and support from the initial phone call through to the completion of the document was clear, thorough and very efficient. I felt I received a personal service tailored to my needs

Client

Thank you for providing such clear advice and executing this in such a painless and professional way. I don’t think I can recall the last time someone did some professional work for me where there were no typos or mistakes, or where I didn’t have to chase and do part of the work myself

Client

Excellent response when initial time constraints were addressed quickly and effectively.

Client

I am very grateful to Thomson Snell & Passmore for helping me through some difficult times; sorting Mum's affairs out when she passed away, between exchanging contracts and completion, sorting her will out, and then making our own wills and LPAs. They gave great advice and support. Thank you

Client

We have always received sensible, knowledgeable, and prompt advice on a range of matters, including estate planning, property transactions, and wills.

Client

We would have no hesitation in recommending the firm. The professional service that we received was exceptional.

Client

They provided a comprehensive strategy for resolving the issues arising in the transaction that we wanted carried out. The advice was clear, and any queries were quickly addressed. Where issues arose with third parties, we received balanced and thoughtful advice on the best course of action. They inspired complete confidence.

Client

The advice that we received specifically addressed the issues that needed to be resolved. The process that needed to be carried out and the likely timescale was clearly laid out. We were kept fully advised as to the progress of the matter throughout. We were given prompt and well considered advice with regard to issues that cropped up.

Client

Sarah listened very carefully to what we wanted; she explained very clearly all of the legal ramifications, and she was highly efficient.

Client

Clare was efficient and very thorough, as well as being a very pleasant person to work with

Client

Very approachable, helpful and diligent.

Chambers High Net Worth

They are hugely experienced and a safe of hands for complex cases.

Chambers High Net Worth

Meet The Team

-

Clare Morison

-

Senior Associate, Private Client

- 01892 701362

- clare.morison@ts-p.co.uk

- View my profile

-

Stuart Goodbody

-

Partner/Head of Trust Management

- 01892 701293

- stuart.goodbody@ts-p.co.uk

- View my profile

-

Sarah Nettleship

-

Senior Associate, Private Client

- 01892 701349

- sarah.nettleship@ts-p.co.uk

- View my profile

-

Nicola Plant

-

Partner/Head of Private Client

- 01892 701330

- nicola.plant@ts-p.co.uk

- View my profile

-

Jessica Pointing

-

Solicitor, Private Client

- 01892 701326

- jessica.pointing@ts-p.co.uk

- View my profile

-

Alan Kitcher

-

Partner – Chartered Certified Accountant, Private Client

- 01892 701230

- alan.kitcher@ts-p.co.uk

- View my profile

-

Una Angus

-

Senior Paralegal, Private Client

- 01892 701299

- una.angus@ts-p.co.uk

- View my profile

-

Rachel Mayston

-

Solicitor, Private Client

- 01892 701325

- rachel.mayston@ts-p.co.uk

- View my profile

-

Simon Mitchell

-

Partner, Private Client

- 01892 701331

- simon.mitchell@ts-p.co.uk

- View my profile

-

Christopher Walker

-

Partner, Private Client

- 01892 701329

- christopher.walker@ts-p.co.uk

- View my profile

-

Mark Politz

-

Partner/Head of Tax Planning

- 01892 701223

- mark.politz@ts-p.co.uk

- View my profile

-

Amy Lane

-

Associate, Private Client

- 01892 701366

- amy.lane@ts-p.co.uk

- View my profile

-

Clare Morison

-

Senior Associate, Private Client

- 01892 701362

- clare.morison@ts-p.co.uk

- View my profile

-

Stuart Goodbody

-

Partner/Head of Trust Management

- 01892 701293

- stuart.goodbody@ts-p.co.uk

- View my profile

-

Sarah Nettleship

-

Senior Associate, Private Client

- 01892 701349

- sarah.nettleship@ts-p.co.uk

- View my profile

-

Nicola Plant

-

Partner/Head of Private Client

- 01892 701330

- nicola.plant@ts-p.co.uk

- View my profile

-

Jessica Pointing

-

Solicitor, Private Client

- 01892 701326

- jessica.pointing@ts-p.co.uk

- View my profile

-

Alan Kitcher

-

Partner – Chartered Certified Accountant, Private Client

- 01892 701230

- alan.kitcher@ts-p.co.uk

- View my profile

-

Una Angus

-

Senior Paralegal, Private Client

- 01892 701299

- una.angus@ts-p.co.uk

- View my profile

-

Rachel Mayston

-

Solicitor, Private Client

- 01892 701325

- rachel.mayston@ts-p.co.uk

- View my profile

-

Simon Mitchell

-

Partner, Private Client

- 01892 701331

- simon.mitchell@ts-p.co.uk

- View my profile

-

Christopher Walker

-

Partner, Private Client

- 01892 701329

- christopher.walker@ts-p.co.uk

- View my profile

-

Mark Politz

-

Partner/Head of Tax Planning

- 01892 701223

- mark.politz@ts-p.co.uk

- View my profile

-

Amy Lane

-

Associate, Private Client

- 01892 701366

- amy.lane@ts-p.co.uk

- View my profile

-

Clare Morison

-

Senior Associate, Private Client

- 01892 701362

- clare.morison@ts-p.co.uk

- View my profile

-

Stuart Goodbody

-

Partner/Head of Trust Management

- 01892 701293

- stuart.goodbody@ts-p.co.uk

- View my profile

-

Sarah Nettleship

-

Senior Associate, Private Client

- 01892 701349

- sarah.nettleship@ts-p.co.uk

- View my profile

Related Services

For You

Probate and Estate Administration Capital Gains Tax advice Personal tax returns Inheritance Tax advice Post death arrangements Estate planning advice Later life planning Wills & estate planning Wills & succession Care of the elderly claims Wills, gifts & other applications Lasting Powers of Attorney (LPA) Will disputes Trust disputes Trust creation & management- Get link

- X

- Other Apps

- Get link

- X

- Other Apps

Comments

Post a Comment